While property investment can be a lucrative venture, it is essential to seek appropriate property tax advice to navigate potential pitfalls.

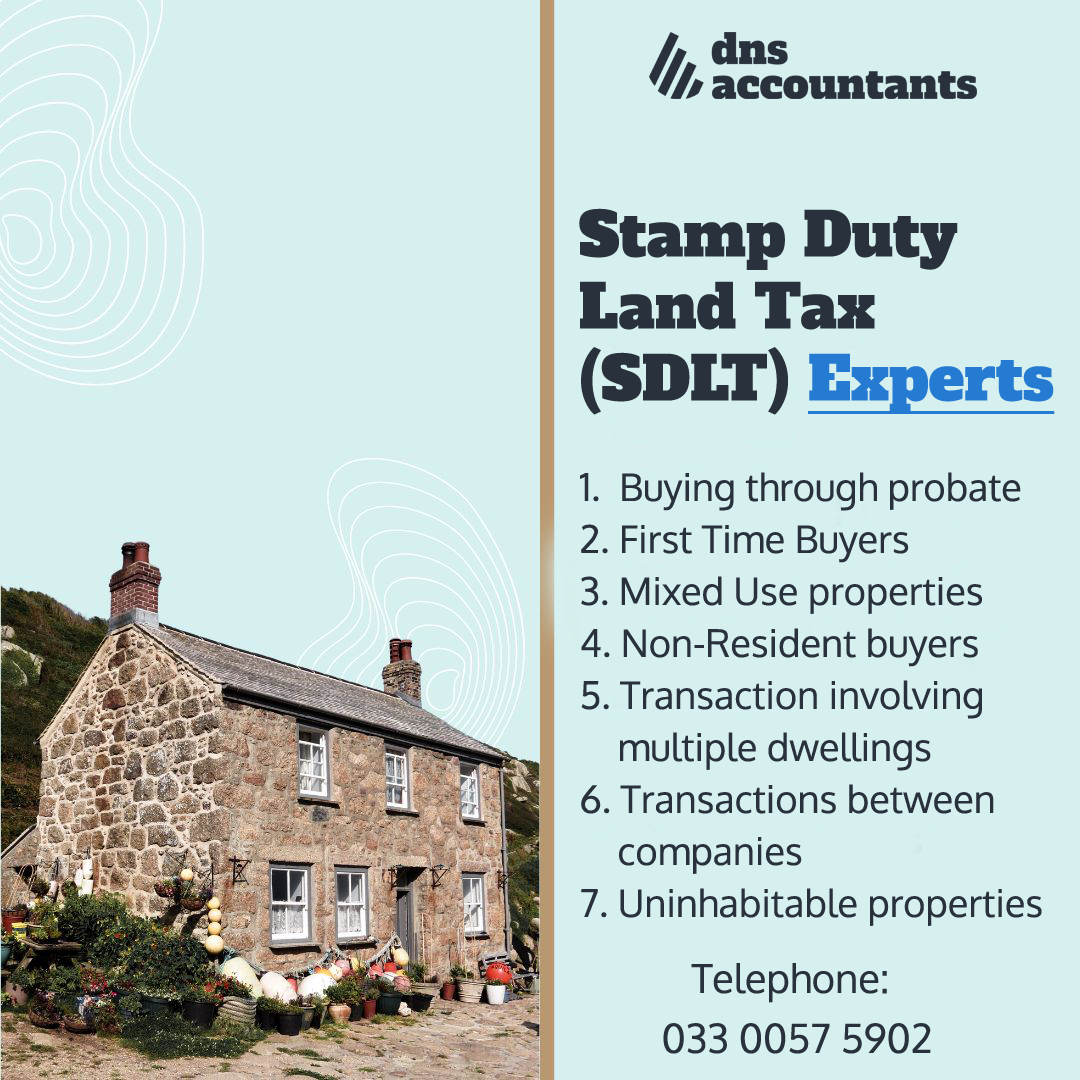

During a property purchase, paying Stamp Duty Land Tax (SDLT) involves submitting a return to HMRC and transferring funds within 14 days of the completion of the property purchase. A conveyancer, agent, or solicitor can handle the tax return as part of the property purchase process.

Without proper guidance, investors may find themselves in a minefield of financial challenges. A faulty Stamp Duty Land Tax Calculator and a widespread lack of understanding regarding the ‘surcharge’ on additional properties contribute to investors paying more taxes than necessary.

Consequently, their investments under-perform due to excessive tax burdens. Seeking expert advice can help investors optimize their tax strategies, ensuring they maximize their returns and avoid unnecessary financial setbacks.

As an investor, it is easy to overlook stamp duty tax or pay an exorbitant higher amount than legally required. Suppose you are an investor – an individual or a business – buying an additional property (that doesn’t replace the primary property) or getting a ‘buy-to-let’ residential property. In that case, you could be paying a higher SDLT or higher surcharge.

With tax rules undergoing a massive re-haul in recent years, it is possible that many businesses and individuals do not have a complete understanding of the tax rules. Owing to this, they might end up overpaying their due tax amounts.

5 based on 800 reviews

5 based on 800 reviews