Are you thinking about buying a second home in the UK? Worried about having to pay stamp duty? Not sure about what the rules say? If you have these questions, you’ve come to the right place at the right time.

In this blog post, we’ll simplify everything that you need to know about stamp duty on a second home, including the rates, exemptions, refunds and ways you can avoid paying it. What are we waiting for? Let’s get right into it.

What is Stamp Duty?

Stamp duty is a tax you’ll need to pay to the government on buying leasehold, freehold property or a piece of land. This ta is called Stamp Duty Land Tax (SDLT) in England and Northern Ireland, Land and Buildings Transaction Tax (LBTT) in Scotland and Land Transaction Tax (LTT) in Wales.

For the sake of simplicity, we’ll be calling it ‘stamp duty’ in the rest of this article.

Does Stamp Duty Apply to All Property Purchases?

It’s worth noting that stamp duty applies only if the property you’re buying is worth more than a certain amount.

Stamp duty applies if the property costs more than £125,000 (£145,000 in Scotland and £180,000 in Wales) and you’re not eligible for first-time buyers’ relief.

The law came into force on 1st October 2021, thus impacting all property purchases from then onwards.

What is First-Time Buyer Relief?

First time buyer relief is a special provision that exempts first-time property buyers from stamp duty tax.

If you’re a first-time buyer and your property costs less than £300,000, you won’t have to pay stamp duty. If the amount is between £300,000 and £500,000, you’ll need to pay stamp duty at a discounted rate.

What is Stamp Duty On Second Home?

As we saw, stamp duty is applicable on all types of property purchases unless you’re eligible for first time buyer relief.

In technical terms, any property you buy in addition to your home is considered to be a ‘second property.’ As per government rules, you need to pay additional stamp duty on all such purchases you make.

How Do I Avoid Stamp Duty on Second Home?

In most cases, paying second home stamp duty is unavoidable. However, there are a few ways to avoid it. Let’s see how:

Purchase some other type of property: You don’t need to pay stamp duty if you want to buy a caravan, houseboat or mobile home.

Buy in a family member’s name.

If you have a property to your name, you could put the property in your child’s name or another family member’s. This way, you won’t have to pay stamp duty but will not be the legal owner of the property. You could put the mortgage in their name and gift them the deposit to do so.

Buy a property under £40,000.

If the value of your property purchase is less than £40,000, you can avoid paying the stamp duty.

How Much Stamp Duty Do I Need to Pay on My Second Home?

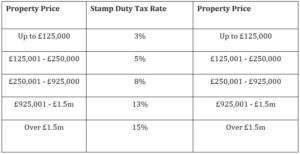

Second-home stamp duty depends on a variety of factors. For instance, you’ll be required to pay an additional rate if you rent your property. Plus, the stamp duty percentage varies as per the property price. Thus, you need to consider all these factors when thinking about buying a second home.

Here’s how much you’ll need to pay:

Can I Get a Stamp Duty Refund If I Sell My First Home?

Yes, you can. You’re eligible to apply for a stamp duty refund if you sell your first property within 36 months of your second purchase. Note here that you can claim the stamp duty you paid for your first property.

To get a refund, you’ll need to submit details to HMRC. You’ll need to inform them about your property details, stamp duty amount, refund claim amount, etc.

Frequently Asked Questions

Can I buy a second home in my spouse’s name?

No, you can’t. As far as stamp duty is concerned, a married couple is considered one person. Thus, you’ll need to pay stamp duty even if only one of you is a legal owner of any property. In case you’re separated for a while, the rules are different.

Do I need to pay additional stamp duty if I live abroad?

Even if your main residence is outside the UK, you’ll need to pay additional stamp duty.

What if I’ve Inherited a Property?

If you’ve inherited 50% or less of a property, you won’t need to pay additional stamp duty. But any more ownership will require you to pay it.