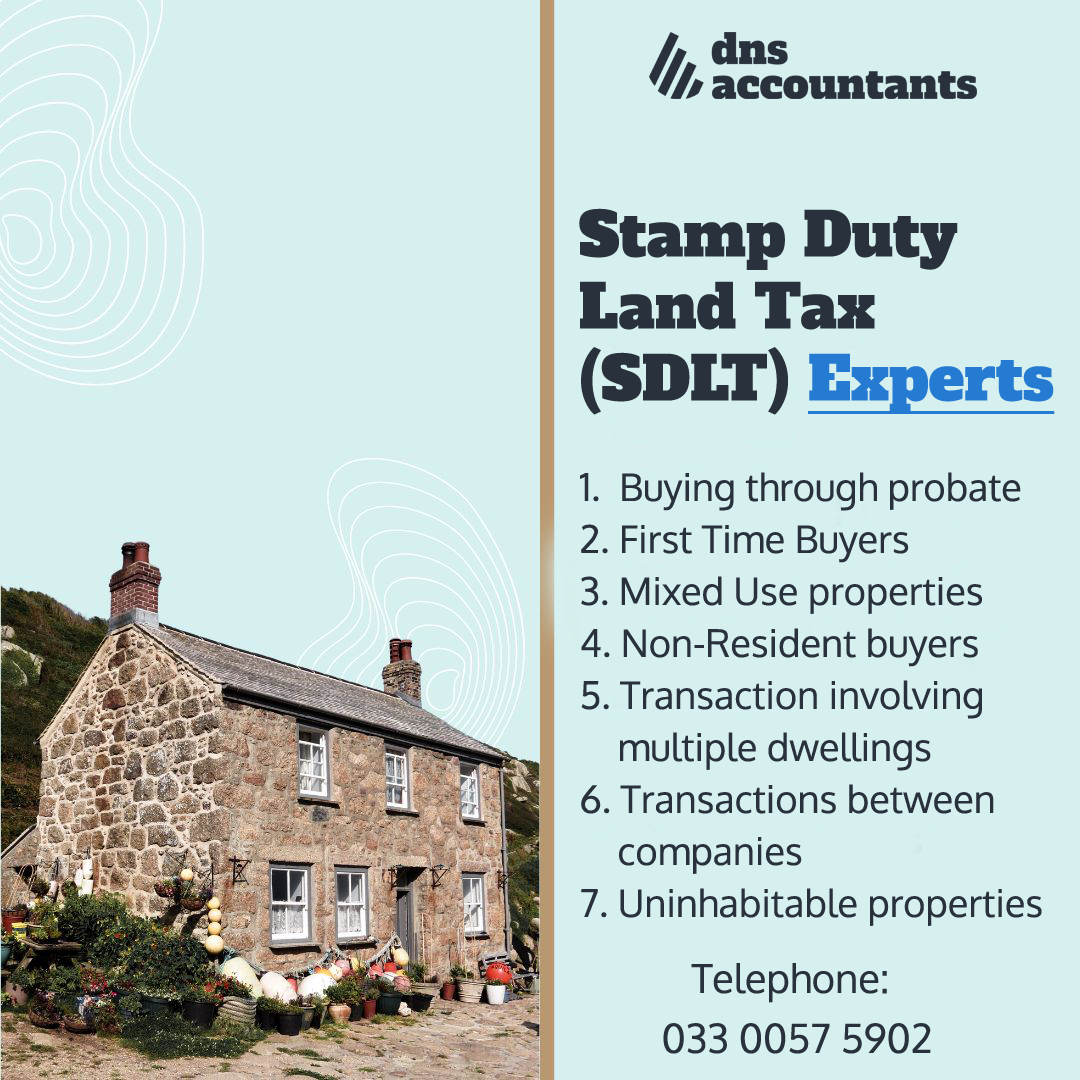

Property Investors Stamp Duty Land Tax (SDLT) Experts

UK’s premier property tax advisers & accountants, providing accountancy services related to Investor SDLT Reclaim and Refund.

Stamp Duty Land Tax is the tax paid to the HMRC office to purchase land or property in the UK whose value exceeds a certain threshold. Most investors tend to overpay their due stamp duty since the entire scope of SDLT laws is vast and challenging to comprehend for most investors.

5 based on 800 reviews

5 based on 800 reviews